No Reviews Found

In today's financial environment, personal money management is essential for people to confidently navigate their financial path. Managing income, expenses, savings, investments, and loans requires careful planning. Careful financial management, which facilitates well-informed decision-making and a strong financial basis, is one of the five essential strategies. These techniques include making calculated investments, developing a detailed budget, and spotting spending patterns. Every route offers essential perspectives on achieving individual financial proficiency and guaranteeing a more resilient future.

A budget, which computes monthly income from sources like employment, freelancing, or investments, is an essential tool for managing personal finances. It includes a breakdown of all monthly expenses, which include variable costs like groceries, entertainment, and eating out, as well as fixed costs like electricity, insurance, and rent or mortgage payments. Monitoring earnings and expenses assists in identifying areas where overpayment occurs and provides guidance on spending priorities and patterns. A certain amount of dedication is necessary for money management. Since using credit cards or borrowing money from friends might result in debt traps, saving money is the first step towards financial freedom. Individuals can attain financial independence and their financial objectives by concentrating on saving.

A savings plan is deciding what your financial goals are and allocating a portion of your income to reach them. This is setting up distinct savings accounts for short-, mid-, and long-term objectives in addition to an emergency fund for unanticipated costs. Saving money consistently and methodically helps people avoid debt traps and quickly reach their financial objectives. Sort your pay into several categories, such as savings, investments, EMIs, and bills. Set aside at least 10% of your monthly income and place it in a liquid fund that holds investments in fixed-income securities.

Identification and repayment of outstanding debt, including credit card debt, student loans, and personal loans, are critical components of debt management, which is crucial for financial well-being. Prioritising the repayment of high-interest payments will help you avoid financial hardship. Repayment plans that prioritise debt elimination above other obligations that just need minimum payments can assist manage debt and reduce interest costs over time. A debt trap can be created by not managing your debt, which might result in you taking out new loans to pay off existing ones. Make regular down payments on goods and think about utilising balance transfers for large-ticket loans to steer clear of debt traps. Instead of taking out loans for tax-inefficient purchases and depreciating assets, save money and accumulate a corpus to meet your objectives.

The subject of personal finance is always changing, necessitating ongoing education and flexibility in response to new situations. Knowledge may be increased with the use of resources including books, seminars, blogs on finance, and online courses. It is easier to adjust tactics to evolving conditions when financial status and goals are routinely reviewed and reevaluated. In India, there is no formal education on handling personal money, so people have to learn it on their own. Basic financial knowledge such as taxation, investment products, budgeting, saving, and financial metrics may be gained from online resources. Gaining these abilities enables people to prepare more effectively, avoid typical blunders, make more informed decisions, and accomplish goals more quickly.

Living paycheck to paycheck might cause financial difficulties since a lot of individuals spend more than they have and incur unforeseen costs. Make a budget to manage them, dividing spending into fixed and variable, urgent and non-urgent, essentials and luxury, and avoidable and unavoidable categories. Set necessities first, then budget for leisure and amusement after covering essentials. Make a shopping list and designate a day when you won't be able to spend any money. To preserve a sound financial status, see sticking to your budget as a commitment rather than a burden.

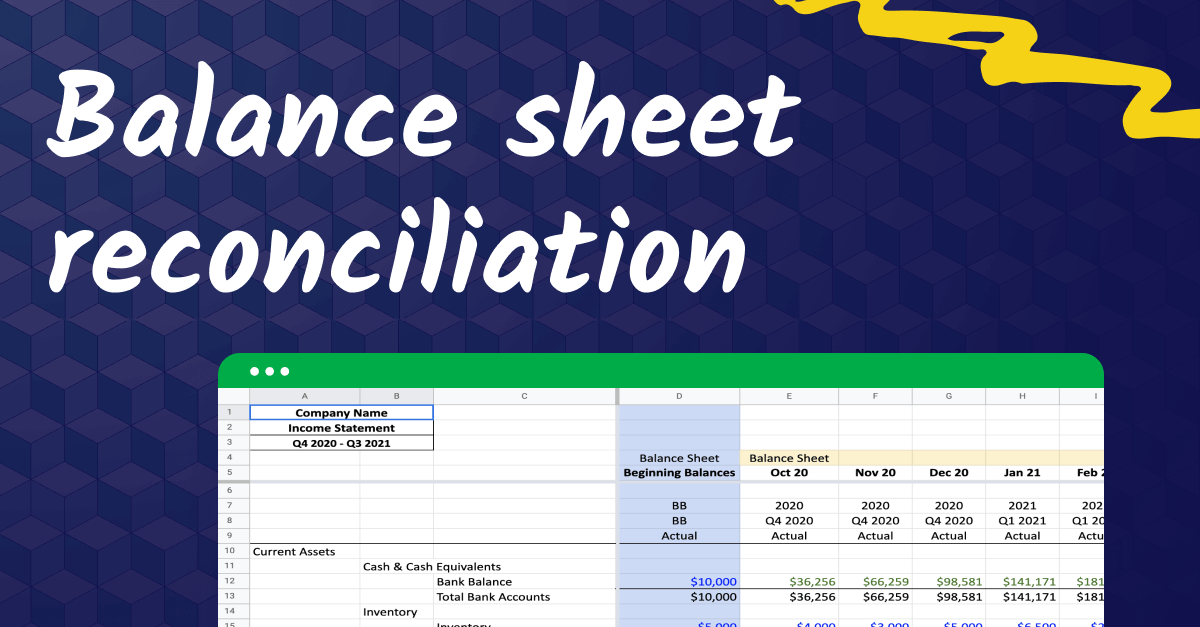

A personal balance sheet is an essential financial tool that compares your assets and liabilities to help you calculate your net worth. Obtaining bank statements and evidence of obligations is the first step. Assets such as investments, bank balances, and house values are listed and added to the total value. Enumerate debts such as credit card balances, auto and house loans, and outstanding sums on other loans. If your total assets exceed your total debt, your net worth is positive; if not, it will gradually rise as you pay back debts. Selecting assets that appreciate and require less upkeep is crucial to asset management.

To maintain financial stability and close the inflation gap, excess cash must be managed. Determining your risk tolerance and your short- and long-term goals are crucial. While risk-averse investors like liquid or balanced funds, high-risk investors may afford a 20% decline in their assets. Think about your objectives and tolerance for risk while choosing an investment refuge. Risk-takers should invest in diversified equities funds, whilst investors with short investment horizons should consider liquid or balanced funds. With the Systematic Investment Plan (SIP) beginning at Rs 500 each month, mutual funds offer a flexible alternative. Under this plan, a predetermined sum is taken out of your savings account and invested in the mutual fund scheme of your choosing.

Equities, debt, and cash are the assets that are allocated while creating an investment portfolio. Equity is not a prudent investment option, despite being tax-efficient and inflation-countering. Aim for a 10- to 15-year investing horizon and diversify your investments by your objectives. To manage market risk, rebalance your portfolio regularly. Investing is an excellent way to build wealth over time, but before making any decisions, be sure you know what you're getting into. Early investment enables compounding, which eventually yields higher profits.

Because of the heightened susceptibility to conditions like diabetes, hypertension, and heart attacks, retirement planning is essential. People must have their finances to pay for the escalating costs of healthcare. Because of the "magic of compounding," starting early might result in lesser accumulation, enabling an early retirement and hassle-free living. Determine the retirement age and the monthly payment required to cover post-retirement costs to plan. For instance, making monthly SIP contributions of Rs 2,900 for thirty years will result in the accumulation of a Rs 1 crore corpus.

Risks to life and property might result in lost revenue and financial instability. Take insurance into consideration to preserve money. Purchasing a Universal Life Insurance Policy (ULIP) might lead to increased expenses and insufficient protection. For more affordable, greater-risk coverage, choose a term insurance plan. The ideal life insurance should be obtained by comparing plans online and covering at least ten times your yearly salary. High-quality medical treatment at affordable costs can also be obtained with health insurance. Keep your costs down by buying only what you need, and think about getting both health and life insurance.

Regardless of one's financial situation, estate planning is crucial since it entails transferring assets to the appropriate recipient in a way that keeps them out of the hands of undesired parties after death. It applies to individuals who cannot afford to give their possessions to an unwelcome party as well as the rich. First things first: a list of beneficiaries and an inventory of assets are made. To guarantee that beneficiaries may easily acquire ownership of assets, a will is also written. If in doubt, a knowledgeable attorney can assist.

Effective tax management is essential for claiming tax exemptions, deductions, and perks that lower tax obligations. Avoiding tax evasion or avoidance is crucial, though. The Income Tax Act's Sections 80C through 80U list deductions. Investing in the Equity Linked Savings Scheme (ELSS), which has the shortest lock-in period and permits tax savings of up to Rs. 45,000 as well as a deduction of up to Rs. 1.5 lakh, is the most effective approach to take advantage of Section 80C. ELSS is a diversified equity fund that uses stock market investments to assist investors in reaching their financial objectives.

For contemporary Indian consumers, personal finance is essential. It entails careful planning, thoughtful investing, budgeting, and spotting spending trends. It includes handling loans, savings, investments, income, and spending. Debt management entails balance transfers, monthly down payments, and the identification and repayment of outstanding obligations. A constant state of financial education is necessary to reach objectives. Other crucial tasks include building an investment portfolio, keeping a balance sheet, rebalancing assets, and practising sensible expenditure management. Retirement preparation protects against medical expenses and preserves financial stability; risk management with life and property insurance is essential.

You must be logged in to post a review

Sign In

A list of the best smart watches for different budgets

Description about the essence & meaning of Paper Bag Day

Description about the essence & meaning of World Population Day

Description about the essence & meaning of Al Hijra

Description about the essence & meaning of Jagannath Rathyatra 2024

Description about the essence & meaning of National Doctor’s Day

Only registered users can see the exclusive deals

Sign InADDA - Your one-stop solution for the best deals and comparison with social shopping online and much

No Reviews Found